This website clarifies the tax obligations for international students and scholars in F and J status whether or not you worked for Tulane.

What is a Tax Return or Tax Filing?

Any of your earnings in the United States are subject to applicable federal and state taxes. Filing tax paperwork, such as a tax return, is a reconciliation that compares what you actually paid in taxes throughout the year to what you should have paid in taxes.

Tulane is required by law to withhold taxes from your paychecks or taxable stipend payments. If the taxes that were withheld from your payment are higher than what you should have paid, you will get a refund after filing your tax return (“tax refund”). If taxes were not withheld, or insufficient tax was withheld, then you will owe money at the time of filing your taxes. You declare your income and account for the taxes owed on a form or set of forms called a “tax return.”

It is your individual responsibility to understand and meet your tax obligations.

Your Tax Obligation: What You Need to Do

Step 1: Determine Your U.S. Tax Residency Status

Your tax status is not the same as your immigration status. For U.S. taxes, and individual is classified as either nonresident alien (NRA) or resident alien (RA). U.S. tax residency status affects.

- Which tax forms you file on your U.S. tax return

- What income you are taxed on

- Eligibility for tax credits and deductions

GLACIER is the easiest way to determine your tax residency status. If you have a GLACIER account, your "Tax Summary Report" will show your tax residency status.

The IRS determines tax residency using two tests: the Green Card Test and the Substantial Presence Test.

Green Card Test

Under the Green Card Test, an individual is considered a resident alien for tax purposes if they were a lawful permanent resident of the United States (green card holder) at any time during the calendar year.

The Substantial Presence Test

The Substantial Presence Test is an IRS rule used to decide whether someone is a nonresident or resident for U.S. tax purposes.

Under this test, the IRS looks at how many days a person is physically present in the United States over a three-year period. A person meets the Substantial Presence Test if they are in the U.S. for at least 31 days in the current year and the total of all days in the current year, one-third of the days from the previous year, and one-sixth of the days from two years ago equals 183 days or more.

"Exempt Years" for F-1 and J-1 Students:

F-1 and J-1 students are generally exempt from the Substantial Presence Test for their first five calendar years in the United States. During these five years, days spent in the U.S. do not count toward the test, and students are usually considered nonresident aliens for tax purposes.

After the five exempt calendar years are used, F-1 and J-1 students must begin counting their days in the U.S. If they are present for enough days under IRS rules, they may become resident aliens for tax purposes.

Here is more information on the IRS website for tax residency status.

Determining your income will help determine what payments were subject to tax withholding and which payment you should expect to be reported on tax forms.

No Income in 2025?

For Resident Aliens:

If you are a resident alien for U.S. tax purposes and you did not receive any income during the tax year, you generally do not need to file a U.S. federal tax return.

For Nonresident Aliens:

If you are a nonresident alien and you were physically present in the United States at any time during 2025, you are required to file Form 8843, even if you did not receive any income during the year.

See below for more information about Form 8843.

Received Income in 2025?

For Resident Aliens:

As a Resident Alien, you are subject to tax rules in the same manner as a U.S. citizen. Your worldwide income is subject to U.S. taxes. You must report all interest, dividends, wages, or other compensation for services, income from rental property or royalties, and other types of income on your U.S. tax return. You must report these amounts whether they are earned within or outside the United States.

For Nonresident Aliens:

There are many different types of payments that may be considered taxable income. These are the types of payments that you may receive from Tulane, or your off-campus employers:

- Wages: Tulane withholds federal and state taxes using graduated rates

- Scholarship/Fellowships for Tuititon and Required Fees: No withholding

- Other Scholarship/ Fellowship Support: (e.g. room, board, stipends, living allowances, travel, awards, emergency funds, etc.) Tulane withholds federal taxes at 14 percent. Louisiana State does not provided a mechanism for withholding on non-wage payments. Therefore, each taxpayer should evaluate whether to make quarterly estimated tax payments to cover the state liability

- Fee/Honorarium/Royalty: Tulane withholds federal income taxes at 30 percent

- Reimbursed Business Expenses for Employees/Short-term Visitors: No withholding

Step 3: Gather Necessary Tax Documents

Tulane will prepare and furnish annual tax statements to all individuals who received payments from the University in the previous calendar year and/or who had a tax treaty exemption.

The type of form(s) you receive from Tulane University depends on your tax situation. Please refer to this table to see what types of forms you may receive.

- If applicable, Form 1042-S will be provided to you either electronically posted or mailed. You will receive email notifications through GLACIER Tax Prep about receiving this form.

- If applicable, Form W-2 can be provided to you electronically through ADP.

If you received income from another employer in 2025, you will also receive tax statements from them.

Step 4: Prepare and File Your Tax Return

For Resident Aliens:

- Use Form 1040 to file federal tax returns

- You may be eligible for Free File Software from the IRS website; or

- You can purchase widely-available tax filing paperwork, such as Turbo Tax; or

- You can also consult a certified tax accountant who is familiar with resident tax filing.

For Nonresident Aliens with U.S. Sourced Income:

- Use Form 1040-NR to file federal tax returns

- If you received payments from Tulane in 2025 AND you are a nonresident alien for U.S. tax purposes, you must file a tax return with the U.S. government. In addition to filing a federal tax return, you may also need file a return on the state level, as well.

- The International Tax Office has purchased GLACIER Tax Prep (GTP) to assist eligible non-resident aliens who earned in preparing their tax return forms.

- GLACIER Tax Prep is a web-based tax return preparation system designed exclusively for nonresident aliens and their dependents.

- More information on accessing GLACIER Tax Prep (GTP) is coming soon.

For Nonresident Aliens with NO U.S. Sourced Income:

- Use Form 8843

The Deadline For Filing:

Federal income taxes with Form 8843: April 15, 2026

Louisiana State income taxes: May 15, 2026

More Information:

Resources for nonresident aliens

2026 Presentations will be posted soon.

Previous Tax Presentations

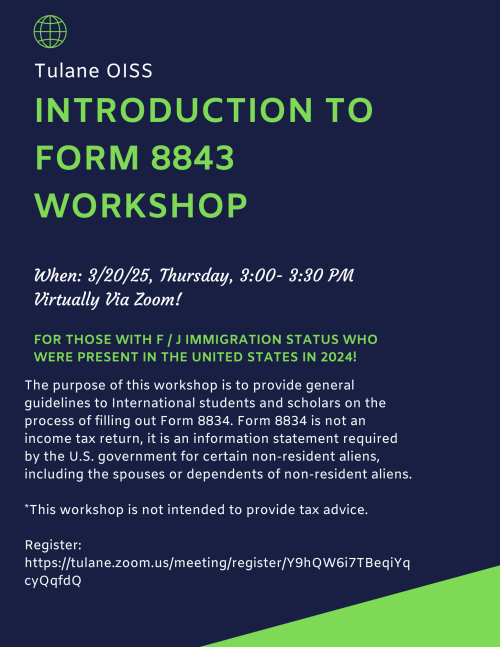

Form 8843 Presentation, 3/20/25

Click here for the 2025 presentation

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Sprintax Tax Information Webinar on February 8, 2024

Click here for the presentation

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Recording of previous Form 8843 2023 Workshop (virtual)

DISCLAIMER: The information above is provided to you for your convenience. It is not intended to be a complete representation of all the I.R.S. income tax regulations. Tulane University disclaims all liability for the misinterpretation or misuse of these materials. In addition, ITO and the OISS do not provide personal tax advice and do not endorse any listed services. The OISS cannot provide further assistance with taxes or answer any questions you have about your personal tax obligations.